If you run a small business or work as a sole trader, you’ve probably seen the phrase “net of VAT” on quotes, invoices, or contracts. But what does it really mean?

Understanding net vs gross pricing is more than just accounting jargon. It affects:

- how much you actually pay suppliers,

- how you set your own prices, and

- how competitive you appear to clients.

Let’s break it down step by step.

What Is VAT?

VAT (Value Added Tax) is a tax on most goods and services in the UK. If you’re VAT registered, you collect it from customers and pass it on to HMRC.

- Standard rate: 20%

- Reduced rate: 5%

- Zero-rated / exempt: Certain food, education, and financial services

VAT is calculated on the net price (before tax).

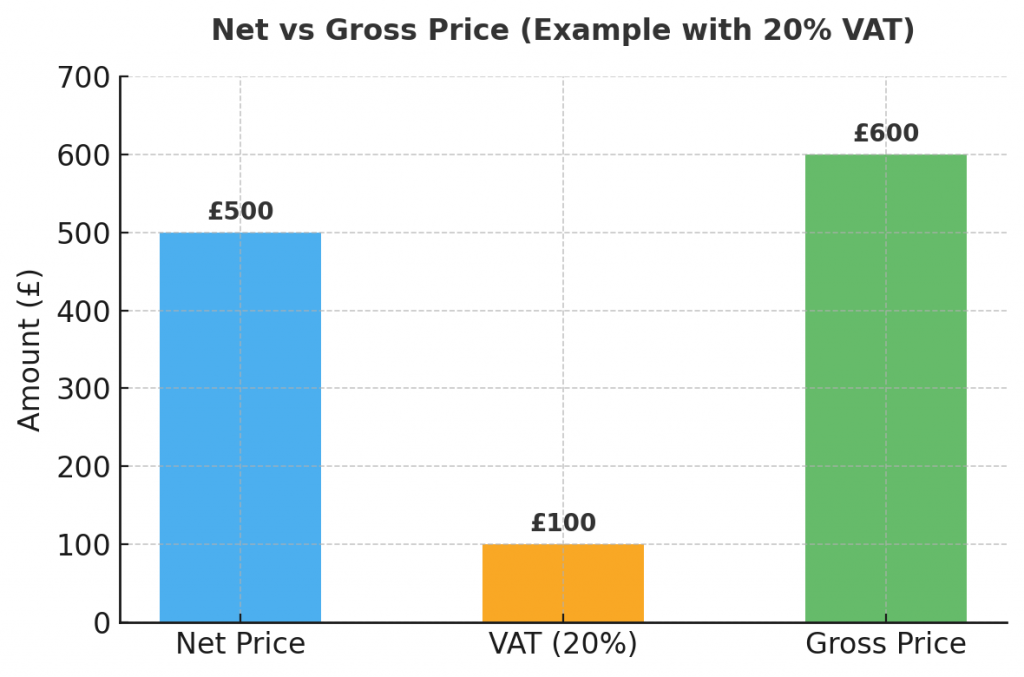

Example:

| Item | Amount |

|---|---|

| Net price | £500 |

| VAT (20%) | £100 |

| Gross price | £600 |

What Does “Net of VAT” Mean?

When something is listed as net of VAT, it means VAT is not included in the price.

👉 A quote of £500 net of VAT = £600 total (if VAT applies).

This matters when comparing quotes: one supplier may show net prices, another gross. Without spotting the difference, you could think one is cheaper when it isn’t.

Net Price vs Gross Price

| Term | Meaning | Common Use |

|---|---|---|

| Net price | Price before VAT | Business-to-business deals |

| Gross price | Price including VAT | What consumers usually see |

Formulas:

- Net + VAT = Gross

- Gross – VAT = Net

Why It Matters for Sole Traders

Whether you think in net or gross depends on if you’re VAT registered:

| Scenario | If VAT Registered | If Not VAT Registered |

|---|---|---|

| Selling | Must add VAT (e.g. £60 → £72) | Don’t charge VAT |

| Buying | Reclaim VAT on expenses (£1,200 → £1,000 net) | Pay full gross amount (£1,200) |

| Quoting | Quote net + VAT | “Net of VAT” = your full cost |

💡 Rule of thumb:

- If your customers are mostly businesses → quoting net makes sense.

- If you sell mainly to consumers → always think in gross.

Common Examples

- Quoting for a job

- Contractor quote: £2,000 net of VAT

- VAT (20%) = £400 → total £2,400

- VAT-registered trader reclaims £400 → effective cost £2,000

- Non-registered trader pays full £2,400

- Buying equipment

- Camera: £1,200 including VAT

- Net £1,000 | VAT £200 | Gross £1,200

- VAT-registered trader reclaims £200 → pays £1,000

- Non-registered pays £1,200

- Selling to consumers

- Tutor charges £60/hour

- VAT registered → must add £12 = £72/hour

- Non-registered competitor can stay at £60 → looks cheaper

VAT Registration Basics

- Compulsory registration: If turnover exceeds £90,000

- Voluntary registration: Worth it if most clients are VAT registered or you have high VAT costs

Helpful Schemes for Sole Traders

- Flat Rate Scheme: Pay a fixed % of gross turnover instead of reclaiming VAT on each expense

- Cash Accounting Scheme: Only pay VAT once clients actually pay you (great for cash flow)

Practical Tips

✅ Always state net or gross on invoices and quotes

✅ Track turnover to avoid VAT penalties

✅ Keep records of net vs VAT amounts

✅ Match your pricing style to your audience (B2B vs consumers)

✅ Plan ahead if you’re close to the VAT threshold

To Sum It Up: Adena Simplifies VAT for Sole Traders

Understanding “net of VAT” helps you price correctly, avoid confusion with clients, and stay compliant with HMRC.

But VAT rules can get tricky as your business grows. That’s where Adena Accounting helps:

- Issue invoices showing net + VAT + gross clearly

- Track VAT automatically

- Stay compliant with HMRC rules

👉 With Adena, sole traders spend less time worrying about VAT—and more time running their business.

Would you like me to also design a simple visual (table/infographic style) for Net vs Gross that you can use in this blog post, so it’s more shareable?